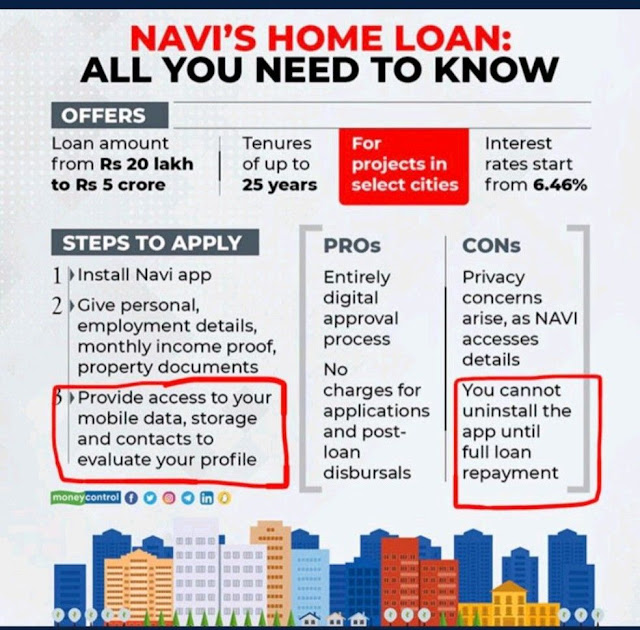

A new (horrible) way to 'disrupt' a space.

|

| Source: https://www.linkedin.com/posts/dashasish_navi-activity-6905031872678887424-Vjqg |

Take a look at the graphic above, extracted from this article. Now, look at the terms here (you may need to click on 'Terms and Conditions' in the footer to get to them). Apparently, the borrower is locked in with an uninstallable app, which if uninstalled, is treated as an attempt to defraud the lender! After the article was written, it seems that the company clarified that the borrower can always write an email while changing the phone (where they must uninstall the app) and that the company would allow this. I mean, wow! This is the level of 'innovation' in FinTech today! What next? Ankle monitors? Sub-cutaneous chip implants?

How many laws are being broken here? Does RBI approve of this? Does Google/Apple app store? Is such an 'agreement', even if signed, binding and enforceable in a court of law? What kind of people are becoming entrepreneurs nowadays?

And all this for a loan secured against an immovable asset! Imagine the terms for unsecured loans, should this become 'normal'.

Are we returning to the time of extortionist moneylenders preying on the needy and gullible again, after working so hard in the early days of independence to eradicate this scourge? By the way, moneylending at ridiculous rates is an activity that still hasn't disappeared fully, but has reduced drastically and pushed underground due to legal provisions, watchdog oversight, and far more financial inclusion than those times. That said, if new technology is going to be used in this fashion, are we really progressing or regressing here? As my late father said, 'Technology is just another tool, like a knife; what matters is whether you are using it to chop vegetables and meat to feed the hungry, or stab people to death, both of which are legitimate uses. A tool is a tool. How you wield it describes who you are.' Tru dat, Baba. Tru dat.

Comments

Post a Comment

Comments to this blog are moderated. Please be patient once you submit your comment. It will appear soon...